A period of fragmentation of the profession has seen an explosion of micro-firms and small firms “start-up” across the country. Advances in technology, practice management software and digital advertising has meant that the barriers to entry have never been so low. And a “remote work” mindset, coupled with ample virtual and serviced office space, has made the allure of self-employment irresistible for many practitioners.

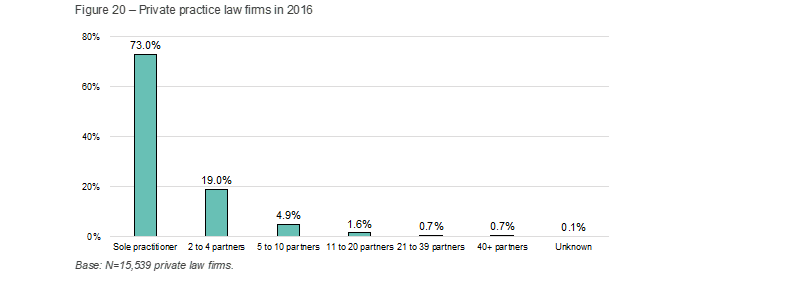

Across Australia, there has been quite a dramatic increase in the number of sole practitioners in recent years. Data reported in the bi-annual National Profile of Solicitors reports published by Urbis for the Law Society of New South Wales, makes for compelling reading. The explosion in the number of practices – an increase of over 20% – occurred between 2016 and 2018, but this was followed by a small contraction. In 2016, there were 15,539 private law firms of which 73% were sole practitioners1:

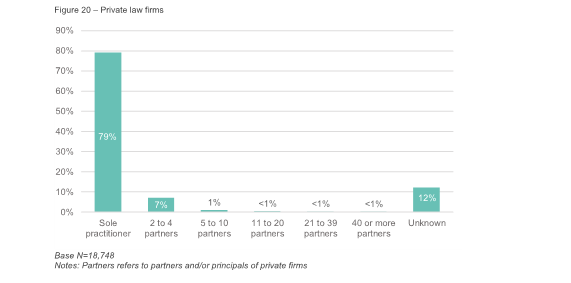

Only 2 years later in October 2018, there were 18,748 private law firms in Australia and of these, 79% had just one principal2.

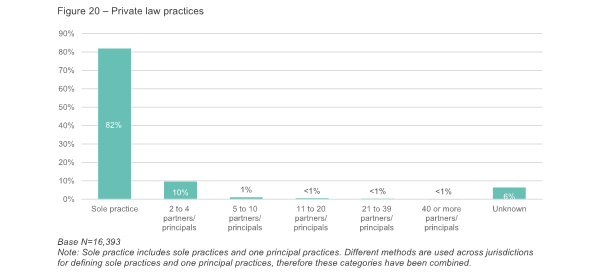

The 2020 report shows yet another increase in the number of sole practices. As of October 2020, there were 16,393 private law firms in the country and 82% of these were operated by soloists3. And this is despite there being a decrease in total practices that year – 16,393 down from 16,435.

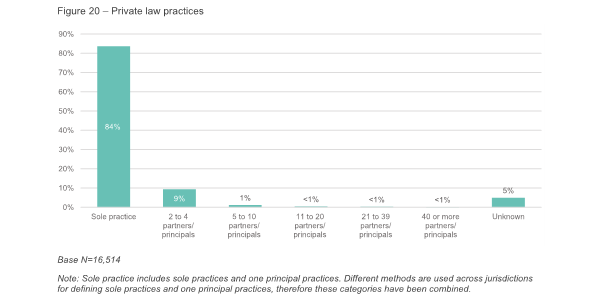

The most recent 2022 report reveals that there were more law practices than in 2020 (16,514 up from 16,393) and that most of these were sole practices (84%)4. Sole practices continue to be on the rise year on year.

The journey from registration of a business name to opening the (often virtual) doors is an exciting time for those on the expedition. And enthusiasm only intensifies as the green shoots of growth appear. Work comes in, a brand starts to build and as head-count increases, the reality hits that this, is a real law firm. But as “forming” moves to “storming” and then on to “norming” (to borrow the concepts of Bruce Tuckman), new challenges arise. Resources become stretched and the founder’s time is at a premium. Prioritising becomes a reality as competing demands of the organisation are given attention on an “as needed” basis, yet little wins keep coming and success breeds success. Growth seems unavoidable, but through this phase, the pathway to achieving a firm’s vision and purpose is littered with the potholes of strategic and operational risks, under the grey skies of compromise and tension.

The clarity of hindsight is truly quite remarkable. In my own experience, when those lightbulb moments occur and the realisation sets in that something could have been done much, much better, we find ourselves wondering: “how the heck did I not see that”. Sometimes these professional faux pas are no more than a speed hump, but others can have lasting consequence to organisational success. In retrospection, I haven’t made every mistake in the proverbial book in scaling a law firm from start-up to meaningful, but it sure feels that way at times. And in sharing these thoughts, I hope that other aspiring practice owners and builders might be able to avoid a few of the blunders that have either been features of my own experience, or ones that I have only narrowly avoided.

My top 13 mistakes in upscaling a professional services firm (and how to avoid them).

- Being a bowerbird – we’re entrepreneurs at heart and are constantly coming up with new ideas, analysing the success of competitors or listening to the input of marketers or brand developers. But in chasing every new shiny thing we see; we’re deviating from strategy and soaking up valuable time and resources. It’s ok to pivot or refine strategy – but only once you’ve fully tested the one that you started with. We need momentum, not just movement. Scrutinise the new ideas by asking why it aligns with our mission and purpose and how it impacts on the broader business. Could it have unintended consequences?

- Speed dating – we’re all in a hurry to get our firm to maturity and that means trying to do lots of things at once, meet lots of people, make truckloads of referral relationships, and have small wins. But doing everything quickly and superficially means that nothing is meaningful. Going to the opening of an envelope 3 times a week might enable you to meet lots of new people, but is it at the expense of building meaningful relationships with power partners that are mutually beneficial?

- Sheep syndrome – it’s always tempting for a new player to look at successful competitors and devise a plan to beat them at their own game. After all, if the approach the rival is using is clearly working, why not just refine, rinse and repeat? But if your founding strategic plan had identified a gap in the market that you hoped to exploit, how can that be achieved if you can’t resist the temptation to follow the well-trodden path taken by the incumbents? Resist the urge to blindly follow. If your plan was to innovate, then stick to that plan. Identify your place in the market and stay in your lane.

- Refractive dysfunction – sometimes professional services firms start out with a really well considered strategic plan or vision. But, through a puppy-like need for pats, we find ourselves being pulled in so many different directions by internal and external stakeholders that we find ourselves suffering from myopia (short-sightedness), hyperopia (long-sightedness) or astigmatism (where we can’t focus on near objects). When we focus our resources on the short term, we neglect the long-term goals. Yes, cash is king, but in constantly chasing it we risk hygiene over health. Focussing only on the long term or not seeing emerging issues, can be equally disastrous as the practice grows but becomes starved of cashflow. We need to consider carefully and strategically what is important in achieving our goals and prioritise them. Looking through both a short and long-term lens will enable better judgements to be made. We can’t forget our mission and purpose as we pursue short term wins.

- Succession skydiving – as businesses grow, value is created, and there will come a time when a founder wants (or needs) to realise a capital return on their considerable efforts. But very often, practitioners are so caught up in the “now” that they don’t think about how they plan to eventually divest themselves of equity. It’s all well and good to want to keep the pie all to yourself, especially when it’s a very big pie that you’ve baked. But that’s a big risk to take. We know that statistically, illness or disability will happen to some of us. There’s a lot to lose when a sudden and unexpected need to retire from the practice occurs at a time when you hold all the equity and have no able or willing buyers to take the practice over. Sadly, it’s an all too familiar tale of woe when a very successful practitioner climbs the professional mountain only to find that they arrive at a precipice where health or personal circumstances force a jump from the profession and value can’t be realised for what they have built. Considered succession planning reduces the risk and can make the difference between having a nest egg, or not!

- Hiring hitchhikers – we hear a lot about the need to create high performing teams, to be results focussed and to deliver on strategic and business imperatives. Yet despite this, we find ourselves making excuses for under-performers and avoiding the hard conversations. A successful firm needs the right people on the bus, in the correct seats and all wanting to get to the same destination. If you pick up hitchhikers who want to head somewhere else, they need to be let off before they exert influence to change seats or alter the itinerary. It’s been a tight labour market and compromises have had to be made at times. But if it isn’t working, help the internal terrorists to find a work-home that is better suited to them – before they damage culture.

- The rudderless ship – strong leadership is a hallmark of successful organisations and in professional service firms where human capital is our key asset, it makes or breaks us. But if our people are the keys to success, why do we invest so much in marketing and so little in developing our leaders? As a firm grows, the founder can’t do it on their own and future leaders at all levels need to be identified and grown.

- Culture clash – the up-scaling boutique likely started with just a handful of people who had known each other before the doors opened. Naturally, they were probably aligned and got along well. But as the firm grows, new staff join the team and bring with them their diverse backgrounds, experiences, and opinions. And this can be great for diversity and breadth of past learnings, but a potpourri of personalities also brings the risk of tensions, dissent and even conflict. In a world in which culture eats strategy for breakfast (as Peter Druick famously pointed out), the up-scaling firm needs to keep one eye on cultural risks because poor culture inevitably means poor performance. In the current talent war, a reputation of having a challenging culture will strangle the ability of a firm to recruit – and that’s a sure way to stagnate growth.

- No time to train – in a small firm, practices, procedures, and technical skill can easily be transferred to the team by osmosis. The close working arrangements make it relatively easy to transfer the knowledge that enables high performance. But as the scale of the organisation increases, rapid ramping sometimes causes competencies to lag expectations and business needs. In a knowledge industry that relies on output and efficiencies to maintain margins, a failure to upskill teams on technical know-how, practices, programs, and policies can have devastating consequences. Documenting processes and policies is non-negotiable. Proper training across all roles increases efficiency and output – imagine what a 20% improvement could do to the bottom line!

- Capital extinction – small firms can be very efficient and low-cost organisations to run. It doesn’t take a lot of revenue to be profitable when expenses are low. But growth sends the expense line northward at a rate of knots and in long-tail sectors where cash flow significantly lags expenditure, profits are quickly consumed by the rising costs. If firms looking to scale don’t have access to adequate capital, it can result in a need to curtail investment in existing campaigns or programs and worst case, cut the expenses that are the driver of new work. If you’re looking to grow your firm, your cash flow forecasts need to sync with your available capital.

- Capacity crash – when the new work is streaming in, and everyone is working at or beyond capacity, the growing firm might have an impressive P&L, but the embers are glowing, and a bushfire is only a gust of wind away. Quite apart from the risk of burnout or loss of key team members, what happens if a couple of experienced professionals leave or can’t work for some reason? Absorbing their work into the team comes at a significant price – like it or not, staff capacities are relatively inelastic. Output will reduce, clients will complain, the team are on edge, morale suffers, and culture cops a hit until a re-build can occur. Resourcing your growing firm to always retain a little extra capacity might cost a little, but it can save a lot. That’s not to say that firms should over-hire, but as a risk management strategy, planning to hold a sensible amount of extra capacity is a sound approach.

- Data darkness – small and micro firms tend to have relatively informal knowledge management systems and decisions are informed by experience or gut feel. But firms looking to grow need to make strategic and business decisions based on data and metrics. In the chaos of rapid growth, many firms overlook the need to put in place systems to capture datasets that inform everything from marketing, financial forecasting, to team performance, industry trends and client matter management. These days, practice management software can do so much of the heavy lifting if we invest in it and are diligent about capturing and recording results. It’s this data that proves the success (or otherwise) of a strategy. And it’s this data that gives management 20/20 vision and can position a growing firm to hold a competitive advantage over its peers.

- The sacred cow – the strategy, processes and organisational structures that worked well as the micro firm grew to be “small” likely won’t be fit for purpose once the firm upscales into the “medium” range. And similarly, the people who cost effectively stewarded the firm through its early stages might not have the skills, experience, or ability to enable high performance in a larger organisation. But all too often, growing firms remained shackled to the ideas, features, approaches and even people that worked in the past. Forget survival of the fittest, in this digital age its survival of the most agile. As the competitive landscape, technology, labour market and regulatory environment change, so too must the scale-ups. Those that remain anchored to the habits of the past and don’t pivot or adapt will quickly find themselves in a competitor’s dust.

The scaling-up roadmap

There’s no silver bullet when it comes to scaling up a professional services firm; but there are plenty of mistake to be made along the way – and I’ve made lots of them in my career. And for law firms, the hyper-competitive environment in which we operate means that the risks are high. One misstep can make the difference between going to the next level, or not. While every area of practice has its nuances and quirks, it’s fair to say that those firms that succeed, share at least a few common attributes: a sound strategy that is regularly tested, a high performing culture, great people, and strong leaders who invest in their teams.

Growing a professional service firm is a challenge at any time, but in a post-Covid world in which WFH and tele-commuting is no longer the exception to the rule, I’m sure there are a number of new mistakes that I’ll be adding to my list in years to come!

As published in Legalwise, QLS Proctor, Lawyers Weekly and The Courier Mail.

Managing Partner

View Bio >