The performance of our Compulsory Third Party (CTP) Scheme impacts a substantial number of Queenslanders with more than 7,500 Compulsory Third Party claims lodged in Queensland each year.

These claims can range from minor whiplash cases through to the most extreme of catastrophic cases involving permanent brain or spinal injury.

Managed by the Motor Accident Insurance Commission (MAIC), the four Queensland licenced CTP Insurers – RACQ, Allianz, QBE and Suncorp – tread an uneasy path in their efforts to deliver an efficient insurance scheme that meets Claimants’ needs, while ensuring profitability and long-term scheme viability.

New standards set to improve claims process

This year the MAIC introduced its first Claims Management Standard, which included a minimum benchmark for how Insurers are expected to manage CTP claims.

According to the Commission, ‘they aim to improve outcomes for people who lodge CTP insurance claims, by promoting fairness, transparency and consistency in claims management.’

The Standards themselves include guiding principles like:

- promoting best practice claims management

- the efficient and fair treatment of Claimants

- effective communication.

Legislation supports speedy resolution of personal injury claims

The legislation which governs the Queensland Scheme sets out objectives which include ‘encouraging the speedy resolution of personal injury claims and promoting and encouraging the rehabilitation of Claimants.’

Against this background, the quarterly reports published by the MAIC performance are instructive. The “CTP Scheme Insights” report reveals detailed data breakdowns, which enable comparisons between the performance of the four licenced CTP Insurers.

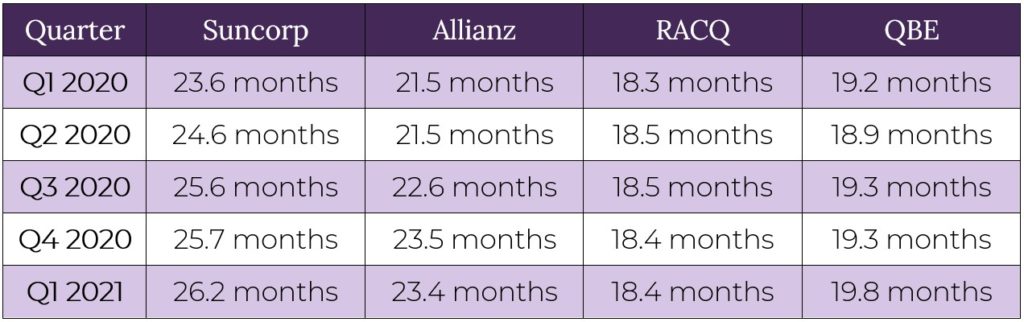

The most recent CTP Scheme Insights contains the following table of claims duration in CTP claims where the Claimant is legally represented:

Legally-represented claimants – Average claim duration (months)

Source: MAIC Quarterly Insights Report Jan to Mar 2021

The duration of a claim can be influenced by injury severity, circumstances around liability, evidence gathering, and claims management approach.

MAIC is continuing to monitor insurers’ claims management practices, including claim durations and stages of settlement. Where variations exist between insurers, MAIC is analysing the data and consulting with insurers to understand the reasons behind it.

The best and worst performers

It’s the insurance arm of Queensland’s peak motoring body RACQ, which is leading the way with the fastest claims resolutions.

Assessing the CTP Scheme Insights data, Suncorp is the worst performing CTP Insurer (closely followed by Allianz) whilst RACQ is to be applauded for managing to finalise claims a staggering 7.8 months quicker than market dominating AAI Insurance. All kudos to RACQ!

Although it is only one measure of performance, claims duration is arguably one of the most important KPIs given that the objects of the Act include the ‘speedy resolution’ of personal injury claims.

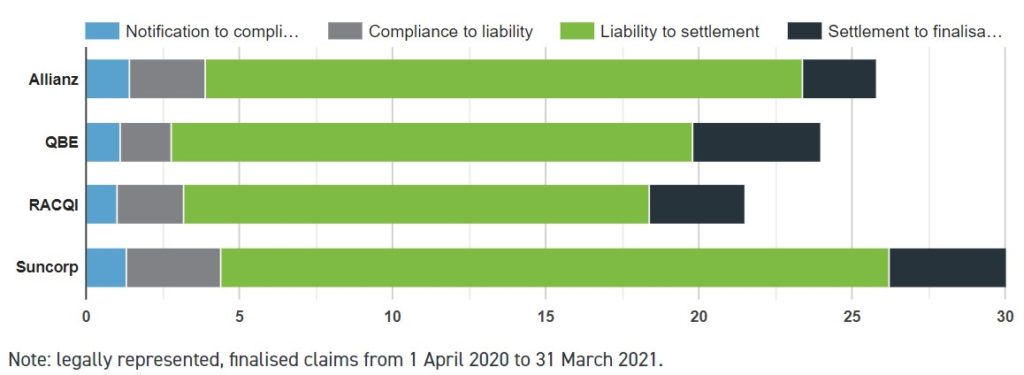

What is perhaps even more instructive is the trend in performance against this claim’s duration metric over the last five quarters reported by MAIC in their Insights:

Trend in performance for insurer’s claims duration over last five quarters

Breaking it down

A simplistic analysis of this data would suggest:

- RACQ is reasonably stable in its claims management duration and are leading the way.

- QBE is also relatively stable, but have had a slight increase in claims duration in the last quarter.

- Allianz have been relatively stable too. The provider is quite slow, but has shown slight improvement in the last quarter.

- Meanwhile, Suncorp has seen an alarming increase in claims duration of 2.6 months in the period from Q1 2020 to Q1 2021.

Kylie Horton, Executive Manager of Qld CTP Claims at Suncorp Personal Injury Insurance says their strategic goal over the next two years is to deliver for their customers best in class claims management which includes settling genuine claims as quickly as possible.

While the likes of Suncorp may have a perfectly reasonable explanation for this increase, I’ve no doubt that MAIC will be keeping a close eye on the performance of all four of Queensland’s CTP insurers.

The Queensland CTP Scheme is undoubtedly the best in the country. It is well run, well managed and profitable for insurers. But justice delayed can be justice denied and there is certainly “room for improvement” for claim durations to quote from my son’s science report card.

Hopefully the introduction of the Claim Management Standards, effective from 1 February 2021, will make a positive difference with swifter delivery of compensation from motor vehicle accidents for CTP Claimants in Queensland.

Travis Schultz & Partners are expert motor vehicle accident lawyers should you ever be looking for a free case review.

Photo by Maxim Hopman on Unsplash

Managing Partner

View Bio >